Armand Rousso, entrepreneur, philanthropist,

chess aficionado

By Frederic Friedel

I

got to know Armand Rousso on January 5th, 2003 – on the telephone. The

founder of a company manufacturing 3D

shutter glasses and computer monitors had just agreed to stage a man vs

machine match between Garry Kasparov and Deep Junior. It was a match which

FIDE president Kirsan Ilyumzhinov had announced but was unable to actually

stage. Rousso, with his company X3D Technologies, had agreed to take over and

do it in the classy New York Athletic Club.

I

got to know Armand Rousso on January 5th, 2003 – on the telephone. The

founder of a company manufacturing 3D

shutter glasses and computer monitors had just agreed to stage a man vs

machine match between Garry Kasparov and Deep Junior. It was a match which

FIDE president Kirsan Ilyumzhinov had announced but was unable to actually

stage. Rousso, with his company X3D Technologies, had agreed to take over and

do it in the classy New York Athletic Club.

Rousso and X3D Technologies had already proved their mettle in chess events.

Just a few weeks earlier they had organised a rapid chess match between Garry

Kasparov and Anatoly Karpov, right on Times Square in the heart of New York

City.

For the match Kasparov

vs Deep Junior Rousso expected a gigantic audience: over a million people

watching live online, he told me. Could we provide the facilities for the Internet

coverage? Indeed we could, ChessBase had developed a cascading Flash technology

for the match Kramnik

vs Deep Fritz in Bahrain the year before.

Kasparov vs Deep Junior on the giant 3D projection screen

Three weeks later I was in New York to set up live Internet broadcast for

giant international news portals which Rousso had won as partners: AOL, Wired,

Der Spiegel, T-Online, Le Figaro, Chathurangam, etc. A number of million people

tuned in, hundreds

of articles were published, and ESPN even transmitted part of the final

game live to their audience.

During this event I met Armand Rousso, a hefty French-born entrepreneur, mid

fifty, brimming with energy and enthusiasm. During his 25-year career he has

created over thirty companies and filed over 100 patents worldwide.

Most impressively Armand was one of the first people to truly grasp the power

of the Internet, as I found out in our extended dinner conversations. That

was back in the mid 1980’s, when the Internet was still referred to as

a "bulletin board" and mainly used by university techies and the

US military.

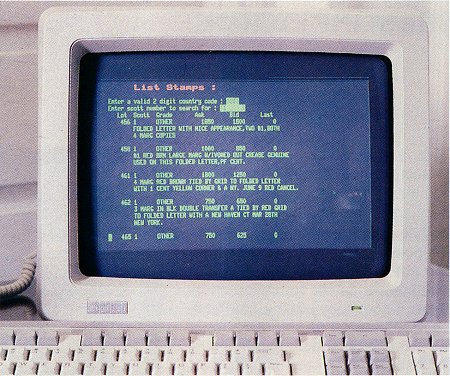

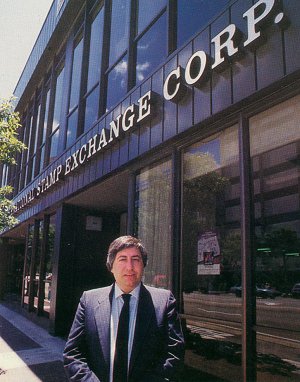

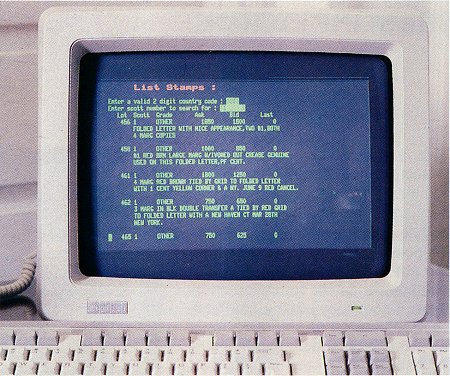

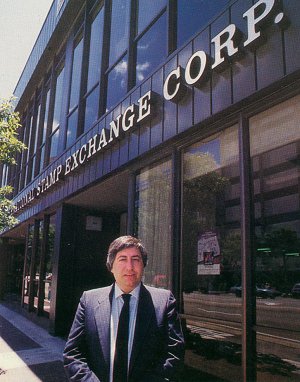

The original real-time e-commerce application, set up by Rousso in 1985

Armand started an e-commerce company, the first on the net, that was just

one step away from Ebay and all of today's online marketplaces. The mind boggles

when one considers what might have happened if he had filed patents at the

time! At the bottom of this page you will find articles

on his International Stamp Exchange.

Garry Kasparov testing the X3D chess display in July 2003

Already in January 2003 Armand was planning the next big event. In July I

travelled to New York again to spend a week with him designing that event.

We came up with a virtual

reality 3D board on which Kasparov would play, wearing X3D shutter glasses

that made the chess set appear to float out of the monitor.

Armand Rousso taking on U.S. Women's Champion Anna Hahn in a blitz game.

Armand is a 2200+ player who recently won a regular game against GM Ron Henley.

During this visit Armand invited me to stay in his Manhattan apartment, so

we could spend the evenings discussing the details of the match and the technology

that was needed. That was a good idea, except that his residence was a tiny

bit distracting...

The view from my bedroom, which directly overlooked Ground Zero

Sunset over the Hudson, as seen from Armand's living room window front

Manhattan and New Jersey by night – how can anyone talk business

and technology when there is such a breathtaking view all around you?

The match between Kasparov

and X3D Fritz was an unprecedented success, generating more media coverage

than any chess game in history. At one stage there were 46,000 articles listed

in Google, the event was carried live on the Internet (through AOL and the

other portals) to literally millions of viewers, and it was shown in 17½

hours of live broadcast on America's biggest cable TV sports channel, ESPN.

During that match I learnt a lot about the art of presentation in chess. Why,

for instance, did the newspapers print so many articles on Kasparov vs X3D

Fritz? Certainly the name was important: if Kasparov plays a fox terrier in

New York, that is going to make the news. Of course the battle of man vs his

nemesis, the machine, fires the imagination of many. But 46,000 articles?

The

trick was of course the glasses, which Armand had talked Garry into accepting.

You can imagine the conversation that took place in thousands of newspaper

offices all over the world. Editor, looking at a picture: "Why is he wearing

dark glasses?" Staff writer: "They are 3D glasses, and he's playing

in a virtual reality environment." Editor: "No chess board?"

Staff writer: "No, just a 3D image which is floating in front of the screen."

Editor: "A hologram! Cool! Do we have copy?" Staff writer: "Plenty,

they sent stories, analysis,..." Editor: "Pictures?" Staff writer:

"Lots and lots. By the way even ESPN..." Editor: "Great, we

put it in full size on page six, with a teaser on page one. Tell me how it

ends. Hope the Kasparov guy wins. That would be so cool."

The

trick was of course the glasses, which Armand had talked Garry into accepting.

You can imagine the conversation that took place in thousands of newspaper

offices all over the world. Editor, looking at a picture: "Why is he wearing

dark glasses?" Staff writer: "They are 3D glasses, and he's playing

in a virtual reality environment." Editor: "No chess board?"

Staff writer: "No, just a 3D image which is floating in front of the screen."

Editor: "A hologram! Cool! Do we have copy?" Staff writer: "Plenty,

they sent stories, analysis,..." Editor: "Pictures?" Staff writer:

"Lots and lots. By the way even ESPN..." Editor: "Great, we

put it in full size on page six, with a teaser on page one. Tell me how it

ends. Hope the Kasparov guy wins. That would be so cool."

Links

Armand's scrapbook

There is a lot more to tell about Armand Rousso – and it will be all

told in time. For instance that he is a very proficient contact magician. Which

is why colleague David Blaine is likely to turn up during his events.

Magician David Blaine at the Kasparov-Karpov match

Armand is also generous to a fault. He is constantly supporting worthy and

unworthy causes, donating large sums to charities, sometimes to the chagrin

of his company. I have seen him impulsively shell out $2,000 in cash (without

any receipt) to a woman grandmaster when he learnt that she did not have a

proper computer.

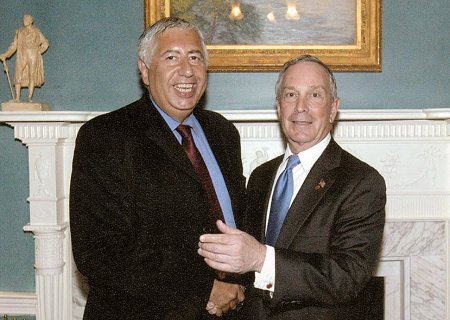

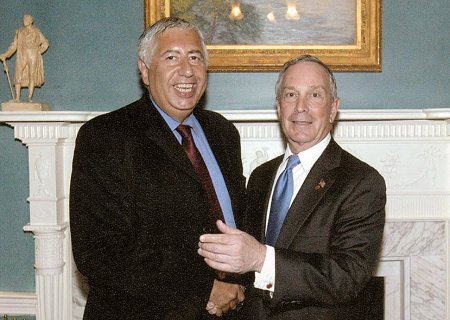

Armand has donated heavily to the USCF and other chess organisations, and

to the New York City Sports Development Commission, chaired by his friend Michael

R. Bloomberg, who has cited him for his numerous charitable efforts benefiting

the children and the underprivileged of the City.

Buddies: Armand Rousso with Mayor Bloomberg of New York City

In lengthy negotiations I was able to get permission to scan some of the pictures

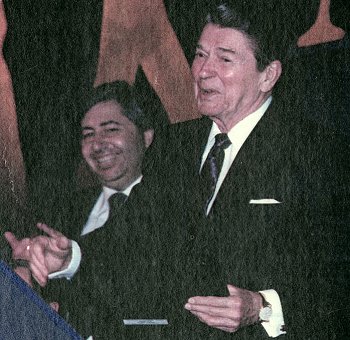

that adorn Armand's apartment and office. Here is a selection of those photos.

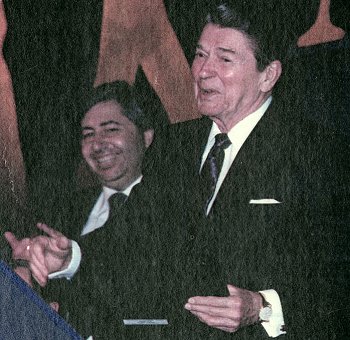

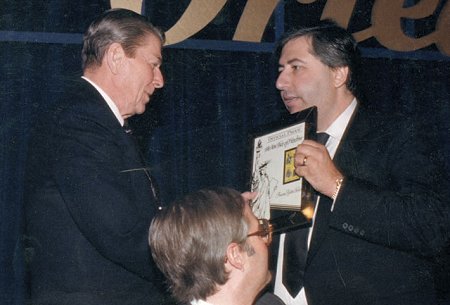

Early picture of Armand with Ronald Reagan, whom he frequently met

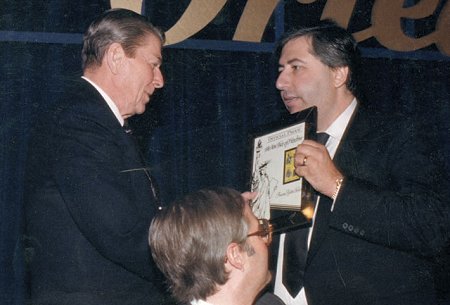

President Ronald Reagan being presented with the Freedom Stamps by Armand

Rousso at the 1988 Senatorial Inner Circle Spring Dinner in Washington, DC.

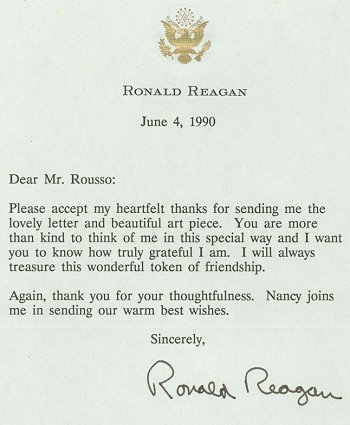

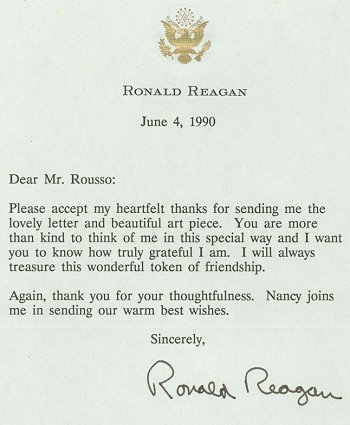

Reagan's letter of thanks to Armand Rousso

President Bill Clinton with Armand Rousso at Clinton’s 50th birthday

party in New York City, 1996

With world welterweight champion and Olympic boxing Gold Medalist Oscar

de la Hoya in 1997

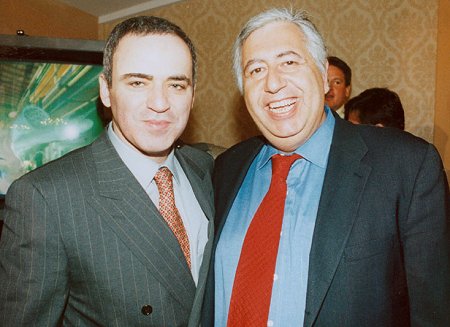

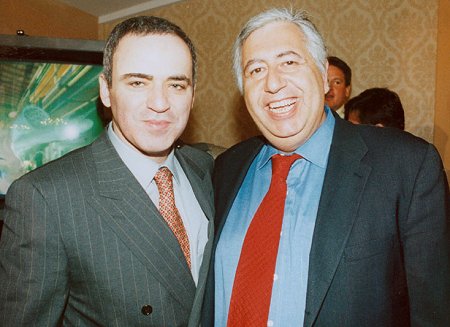

Garry Kasparov and Armand Rousso during the first man vs machine in 2003

Armand with Anatoly Karpov, a fellow philatelist, in New York 2002

From the dawn of the Internet

THE WEEKLY NEWS MAGAZINE

TIME, October 7, 1985

Trading Stamps by Computer

Most

people use stamps to mail letters. Rousso trades them for expensive houses,

yachts and cars. A Miami Beach philatelic broker, Rousso, 35, says that official

catalogs value the rare stamps that he has traded since 1984 at $45 million.

Now he is taking the art of stamp trading into the computer age. Starting this

week, collectors worldwide will be able to buy and sell rare stamps via telex

through Rousso's Miami-based International Stamp Exchange Corp. In

a month, stamp buffs will also be able to trade through personal computers.

Most

people use stamps to mail letters. Rousso trades them for expensive houses,

yachts and cars. A Miami Beach philatelic broker, Rousso, 35, says that official

catalogs value the rare stamps that he has traded since 1984 at $45 million.

Now he is taking the art of stamp trading into the computer age. Starting this

week, collectors worldwide will be able to buy and sell rare stamps via telex

through Rousso's Miami-based International Stamp Exchange Corp. In

a month, stamp buffs will also be able to trade through personal computers.

Rousso expects some 300,000 U.S. collectors and thousands more abroad to use

ISEC, for which they will pay 3% buyer’s fees and 6% selling commissions.

By making trading convenient, he also expects to attract new collectors. To

ensure the authenticity and quality of stamps listed on the exchange, ISEC’s

staff experts will take possession and verify descriptions before posting sell

orders. The price a buyer will pay for a stamp, of course, depends on numerous

factors. The famous “Inverted Jenny” from the first U.S. airmail

issue in 1918 is especially valued by collectors for one striking error: the

airplane is flying upside down.

New York, Friday, January

3, 1986

Frenchman in Florida Creates ‘Big Board’ for Stamp Trading

...Rousso, the owner and chairman of the International Stamp Exchange Corporation

of Miami Beach believes he can revive interest in philately with a combination

of publicity and the lure of profit. “There is not doubt that collecting

stamps is not seen today as a modern, fashionable hobby” he said. “We

are trying to dust it off and show, especially to young people, that it can

be great fun and, what is more important, very profitable.”

In the exchange, which opened in October and which Mr. Rousso expects to

be fully operational later this month, descriptions of each stamp, including

the owner’s asking price, are fed to a computer. Potential buyers, dealers,

or individuals who have telex terminals or personal computers can see the exchange’s

listings of stamps and enter bids on them. If the bid equals the price asked,

the sale is automatically completed by the exchange. If the bid is lower, the

seller can choose to accept it. Buyers are charged 3 percent and sellers are

charged 6 percent. Auction houses usually collect 10 percent from both the

seller and the buyer.

Mr. Rousso said that in a 10-day period from the last of November to the

first week of December, the exchange’s volume of business was $400,000

and increased daily. Mr. Rousso placed a $3 million value on the stamps the

exchange initially offered for sale and said the value of those listed now

was about $75 million. The number of serious American stamp collectors, who

annually invest several hundred dollars in their collections, is estimated

at some 200,000, although the number who dabble in philately could be ten times

that number. His experience as a collector and dealer has led to a network

of 200 authorized representatives in the United States. Through them, people

who do not own computers can buy or sell stamps on the exchange. Mr. Rousso

also has subsidiaries in Austria, Brazil, Canada, France, Britain, Italy, Japan,

Switzerland, and West Germany.

Stamp Traders New Exchange Widens Market

The new office houses a computer containing information on stamps for sale-about

one million at the moment. Traders can gain access to the exchange, and make

trades, through their own personal computers. Or they can trade through brokers

at the exchange or through any of 150 dealers who are exchange members.

Sellers

set the “ask” prices they want for stamps, which they turn over

to be graded and insured by exchange officials and stored in vaults pending

their sale. Meanwhile, buyers submit “bid” prices, which

are compared with the sellers’ ask prices. If the bid and ask prices

match, a computer automatically records a sale. If the prices are close, the

buyer and seller are invited to negotiate. When sales occur, the exchange typically

collects a commission of 3% from buyers and 6% from sellers. That compares

with a commission of 10% collected from each side at most major stamp auctions.

Sellers

set the “ask” prices they want for stamps, which they turn over

to be graded and insured by exchange officials and stored in vaults pending

their sale. Meanwhile, buyers submit “bid” prices, which

are compared with the sellers’ ask prices. If the bid and ask prices

match, a computer automatically records a sale. If the prices are close, the

buyer and seller are invited to negotiate. When sales occur, the exchange typically

collects a commission of 3% from buyers and 6% from sellers. That compares

with a commission of 10% collected from each side at most major stamp auctions.

One advantage for the collector is access to up-to-date prices. Previously,

if an investor sought to sell stamps, say, six months after a catalog was issued,

the printed price would often be outdated. And unscrupulous dealers could take

advantage of the difference. The exchange also enables investors to quickly

shop around for the best price. At the same time, individual dealers can offer

a wider range of stamps to clients without personally having to store them.

Rousso, the exchange’s chairman, says his computer network will “inject

fresh money into the market that will benefit everybody.” In its first

six months, the exchange handled about $1 million in transactions, Mr. Rousso

says.

Dealers say that’s still only a tiny fraction of philatelic revenue,

which many estimate at $500 million a year. Yet some participating collectors

are enthusiastic. The exchange “has done for stamps what Nasdaq did for

the OTC market in the 1970’s,“ says Moshe Rimson, and avid collector

and the president of M. Rimson & Co., a New York stockbroker. Adds Lewis

Berg, the vice president of Southeastern Stamp Co., a Hollywood, Fla. Auctioneer:

“It should bring the stamp business into the modern era.”

September 9, 1985

On Sept. 30, investors will be able to buy and sell rare stamps that way they

trade securities-by computer. Collectors used to be limited to catalogs, dealers,

and auction houses. But soon they can tap a new electronic market, run by the

International Stamp Exchange Corp. in Miami Beach that will feature up-to-date

prices and bids.

Using the market requires only a computer with a modem and 60 cents a minute

for line charges. Traders will have access to data on more than 800,000 stamps,

plus the services of at least 200 stamp dealers acting as brokers. The brokers

will share a 6% sellers’ fee and a 3% buyer’s fee that the exchange

will charge traders using this service.

Rousso, a leading trader of rare stamps who is chairman, president, and founder

of ISE. Anyone with a computer and a modem can contact ISE, get a password,

and call in. The service will also be available via MCI International Inc.’s

“Insight,” a 24-hour news and information service. The wholesale

and retail market for stamps worldwide adds up to about $470 million each year.

Now Rousso predicts the exchange will enable the rare-stamp market to “at

least double” by 1990.

September 16, 1985

People to Watch

Rousso, 35, has come a long way from his teenage days in Paris when he used

to barter old stamps for meals in a Chinese restaurant. Now based in Palm Beach,

Florida, Rousso in the past 18 months has exchanged millions of dollars worth

of rare stamps for yachts, real estate, and private jets, most of which he

then sold to reinvest in more stamps. Anyone looking to get portable assets

in return for a spare oil well or gold mine will have to wait, though, as Rousso

has suspended dealing to concentrate on his International Stock Exchange, due

to open September 30. Philatelic traders will hook up through the exchange

via computer or telex, paying Rousso a percentage of each transaction’s

value. Rousso acquired the venture’s Miami Beach office space for about

$1.5 million-in stamps. “That’s the fun of it,” he says.

I

got to know Armand Rousso on January 5th, 2003 – on the telephone. The

founder of a company manufacturing

I

got to know Armand Rousso on January 5th, 2003 – on the telephone. The

founder of a company manufacturing

The

trick was of course the glasses, which Armand had talked Garry into accepting.

You can imagine the conversation that took place in thousands of newspaper

offices all over the world. Editor, looking at a picture: "Why is he wearing

dark glasses?" Staff writer: "They are 3D glasses, and he's playing

in a virtual reality environment." Editor: "No chess board?"

Staff writer: "No, just a 3D image which is floating in front of the screen."

Editor: "A hologram! Cool! Do we have copy?" Staff writer: "Plenty,

they sent stories, analysis,..." Editor: "Pictures?" Staff writer:

"Lots and lots. By the way even ESPN..." Editor: "Great, we

put it in full size on page six, with a teaser on page one. Tell me how it

ends. Hope the Kasparov guy wins. That would be so cool."

The

trick was of course the glasses, which Armand had talked Garry into accepting.

You can imagine the conversation that took place in thousands of newspaper

offices all over the world. Editor, looking at a picture: "Why is he wearing

dark glasses?" Staff writer: "They are 3D glasses, and he's playing

in a virtual reality environment." Editor: "No chess board?"

Staff writer: "No, just a 3D image which is floating in front of the screen."

Editor: "A hologram! Cool! Do we have copy?" Staff writer: "Plenty,

they sent stories, analysis,..." Editor: "Pictures?" Staff writer:

"Lots and lots. By the way even ESPN..." Editor: "Great, we

put it in full size on page six, with a teaser on page one. Tell me how it

ends. Hope the Kasparov guy wins. That would be so cool."

Most

people use stamps to mail letters. Rousso trades them for expensive houses,

yachts and cars. A Miami Beach philatelic broker, Rousso, 35, says that official

catalogs value the rare stamps that he has traded since 1984 at $45 million.

Now he is taking the art of stamp trading into the computer age. Starting this

week, collectors worldwide will be able to buy and sell rare stamps via telex

through Rousso's Miami-based International Stamp Exchange Corp. In

a month, stamp buffs will also be able to trade through personal computers.

Most

people use stamps to mail letters. Rousso trades them for expensive houses,

yachts and cars. A Miami Beach philatelic broker, Rousso, 35, says that official

catalogs value the rare stamps that he has traded since 1984 at $45 million.

Now he is taking the art of stamp trading into the computer age. Starting this

week, collectors worldwide will be able to buy and sell rare stamps via telex

through Rousso's Miami-based International Stamp Exchange Corp. In

a month, stamp buffs will also be able to trade through personal computers.

Sellers

set the “ask” prices they want for stamps, which they turn over

to be graded and insured by exchange officials and stored in vaults pending

their sale. Meanwhile, buyers submit “bid” prices, which

are compared with the sellers’ ask prices. If the bid and ask prices

match, a computer automatically records a sale. If the prices are close, the

buyer and seller are invited to negotiate. When sales occur, the exchange typically

collects a commission of 3% from buyers and 6% from sellers. That compares

with a commission of 10% collected from each side at most major stamp auctions.

Sellers

set the “ask” prices they want for stamps, which they turn over

to be graded and insured by exchange officials and stored in vaults pending

their sale. Meanwhile, buyers submit “bid” prices, which

are compared with the sellers’ ask prices. If the bid and ask prices

match, a computer automatically records a sale. If the prices are close, the

buyer and seller are invited to negotiate. When sales occur, the exchange typically

collects a commission of 3% from buyers and 6% from sellers. That compares

with a commission of 10% collected from each side at most major stamp auctions.